-

App information

-

Platform version information

-

App privacy

-

Age ratings

-

Provide app motion information

-

Required, localizable, and editable properties

-

App bundle information

-

App pricing and availability

-

App and submission statuses

-

App build statuses

-

App Store localizations

-

App Store pricing and availability start times by country or region

-

App Sandbox information

-

App review information

-

Maximum build file sizes

-

Export compliance documentation for encryption

-

TestFlight tester information

-

Beta tester feedback

-

App preview specifications

-

Screenshot specifications

-

Role permissions

-

User notifications

-

Generate catalog reports

-

App catalog report

-

Game Center achievement catalog report

-

Game Center leaderboard catalog report

-

In-app purchases catalog report

-

In-app purchase types

-

In-app purchase information

-

Auto-renewable subscription information

-

Pricing and availability

-

In-app purchase statuses

-

In-app purchase localization statuses

-

Auto-renewable subscription price increase thresholds

-

In-app event statuses

-

In-app event badges

-

Media and audio specifications

-

Leaderboards

-

Achievements

-

Group properties

-

App version properties

-

App metrics

-

App Clip metrics

-

In-app event metrics

-

Performance metrics

-

App analytics filters and dimensions

-

Product page optimization

-

Payment information

-

Financial report fields

-

Transaction tax report fields

-

Apple legal entities

-

Currency codes

-

Financial report regions and currencies

-

Minimum payment threshold

-

Summary Sales Report

-

Sales Events Report

-

Pre-Order Report

-

Subscription Report

-

Subscription Event Report

-

Subscriber Report

-

Subscription Offer Redemption Report

-

Magazines & Newspapers Report

-

Report file names

-

Subscription events

-

Promotional codes

-

Product type identifiers

-

Cancellation reasons

-

Sales and Trends metrics and dimensions

-

Sales and Trends reports availability

-

Banking information

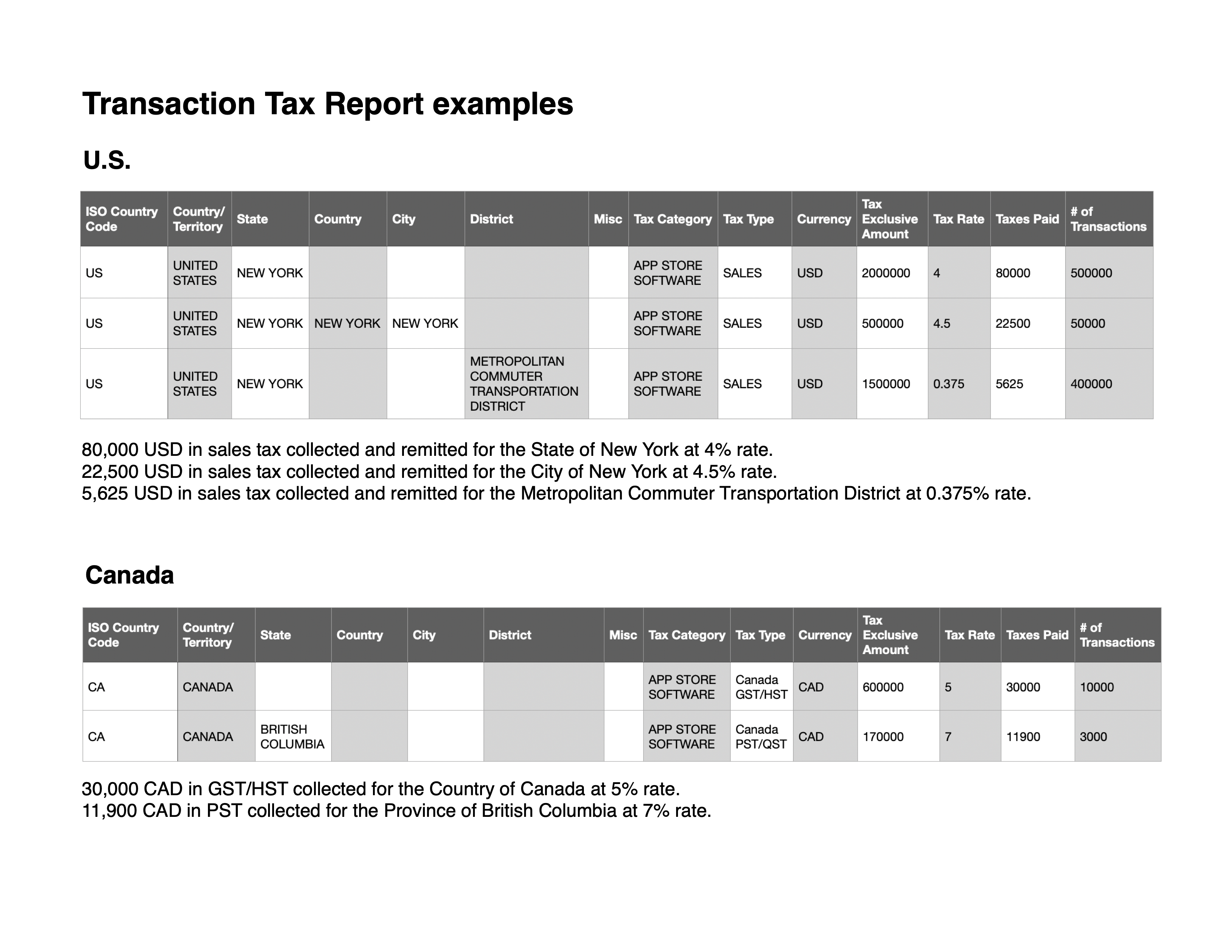

Transaction tax report fields

The transaction tax report is a monthly report summarizing sales tax, use tax, goods and services tax and other similar taxes applied on transactions in the U.S. and Canada. The table below shows columns for the Transaction tax report.

Sample transaction tax report

|

Field title |

Description |

|---|---|

|

ISO Country Code |

Two-character ISO code for the country as determined by the customer's billing address. |

|

Country/Territory |

The country or region as determined by the customer’s billing address. |

|

State |

The state/province as determined by the customer’s billing address. |

|

County |

The county as determined by the customer’s billing address. |

|

City |

The city as determined by the customer’s billing address. |

|

District |

The district as determined by the customer’s billing address. |

|

Misc |

Additional customer billing address information relevant for taxation (e.g. Texas transit district, Colorado local improvement district). |

|

Tax Category |

The tax category is used to determine the tax rate for your app in each tax jurisdiction. |

|

Tax Type |

The type of transaction tax (e.g. sales tax, use tax, goods and services tax, and other similar taxes). |

|

Currency |

Three-character ISO code for the currency type paid by the customer. For example, USD for United States Dollar. |

|

Tax Exclusive Amount |

The amount of customer sales taxed at a given rate minus the tax amount reflected in the Taxes Paid column. |

|

Tax Rate |

The tax rate applied to these transactions. |

|

Taxes Paid |

The total transaction tax (sales tax, use tax, goods and services tax, and other similar taxes) amount per tax rate in the customer currency for these transactions. |

|

# of Transactions |

The number of transactions taxed at a given rate in each jurisdiction. Note that this only includes transactions without a corresponding refund. |